After nearly a decade of trying, Apple finally gave up its efforts to produce an electric car last year, canceling the $10 billion project, according to the New York Times.

But last year in China, electronics maker Xiaomi launched its first electric car after just three years of development and delivered 135,000 vehicles. It has promised to double that number in 2025.

Xiaomi's ability to succeed where Apple has failed shows just how much China dominates the EV supply chain. Chinese companies have mastered the electric vehicle industry. Using this infrastructure, Xiaomi has been able to get components quickly and cheaply.

A growing number of Chinese electric vehicle companies, including Leapmotor, Li Auto and Seres Group, are starting to turn a profit after years of burning through cash in their intense competition for the world's largest car market.

And Xiaomi isn't the only Chinese consumer electronics company to target electric vehicles. Telecommunications giant Huawei, which the U.S. government has targeted for years with sanctions and legal action, makes autonomous driving software. Huawei has teamed up with multiple Chinese automakers, including Seres Group and state-owned firms SAIC Motor, BAIC and Chery.

Xiaomi has long been compared to Apple. It has made bets that its rivals have been quick to imitate, such as selling its cheap, high-design phones mainly online. Its CEO Lei Jun even dressed like Apple co-founder Steve Jobs - in jeans and a black shirt - for the launch of Xiaomi's first phone in 2011.

Xiaomi's first electric car was unveiled in March last year: the SU7, a four-door sedan with artificial intelligence features that can help with parking, play movies to passengers and program Xiaomi's home appliances from the road. Mr. Lei said it looks like a Porsche. But at $30,000, it's a quarter of the price.

Xiaomi makes all sorts of electronics, from robot vacuum cleaners to air conditioners, that connect through its operating system and are controlled in its app. In some ways, the SU7 is just another gadget. It can use data collected from other devices about a driver's daily routine to determine the best time to charge the car's batteries.

"Xiaomi has really started to infiltrate your home. Everything is interconnected and that's something other companies couldn't do," said Gary Ng, an economist at Natixis Corporate & Investment Banking.

Although the SU7 brought Xiaomi only a fraction of the sales of China's leading electric carmakers, it puts Xiaomi among the Chinese companies dealing a major blow to the long-standing dominance of foreign automakers in China's premium car market. In the year since the SU7 went on sale, Porsche's deliveries in China have fallen by nearly 30%.

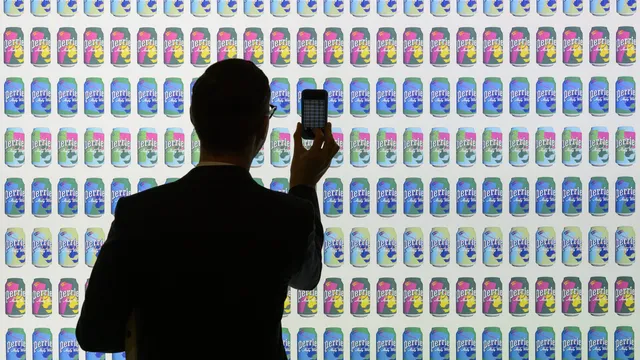

On Thursday (27.02) evening in Beijing, Xiaomi launched a high-end version, the SU7 Ultra, alongside a premium version of its latest smartphone. The company made a flash teaser for the vehicle by racing a prototype on Germany's Nürburgring circuit, where Xiaomi says it has set a record for "fastest four-door sedan".

Xiaomi also plans to launch a sports car, the YU7, this year, according to regulatory filings in China.

Chinese electric vehicle companies have benefited from billions of dollars in government support, which has helped them gain control of the supply chain down to the minerals in the cars' batteries themselves. That early advantage helped two Chinese companies, BYD and Contemporary Amperex Technology Company , known as CATL and added to the Pentagon's list of Chinese military companies in January, become the world's largest electric battery makers.

Xiaomi is using this supply chain to its advantage. Its vehicles contain batteries from BYD and CATL. It was able to quickly start production by taking over a factory from Beijing Auto Group. Construction workers in Beijing have been working around the clock to build a second factory.

All this production capacity helps Chinese electric car firms go from development to production in a much shorter time than traditional carmakers in China, enabling them to bring new models to market quickly and focus on creating software they can continually update, says Stephen Wu. Dyer, head of Asia automotive at consultancy AlixPartners.

Strong competition at home has led many Chinese automakers to flood the global auto market with affordable electric cars. Last year, BYD sold more than four million new cars worldwide.

It's only a matter of time before Xiaomi's cars hit the roads outside China, said Kui Dongshu, secretary-general of the China Passenger Car Association.

Xiaomi's popularity as a maker of all kinds of consumer electronics gives it deep insights into Chinese consumers' preferences. On the first day the SU7s were delivered, buyers could go to Xiaomi's app store and get accessories to trick out the cars, such as analog clocks on the dashboard and a number of physical switches that attach to the touch-screen panel.

"The strength of the brand puts Xiaomi ahead of many of their competitors. That's what it takes to sell cars globally because it's not just a consumer product, it's an emotional product," says Tu Le, managing director of consultancy Sino Auto Insights. | BGNES

Breaking news

Breaking news

Europe

Europe

Bulgaria

Bulgaria